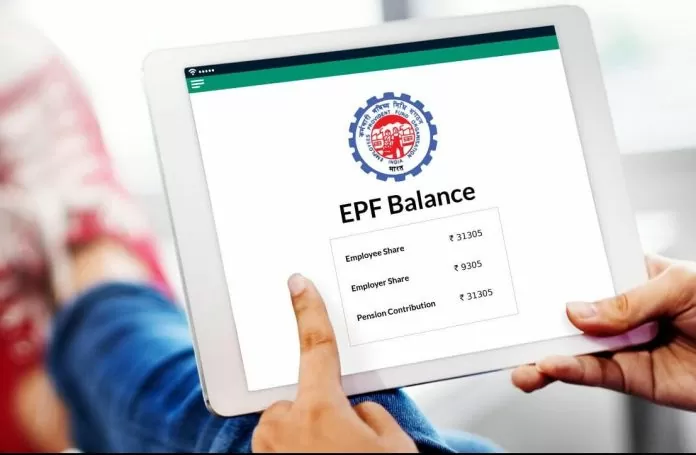

The Central Board of Direct Taxes (CBDT) has relaxed the rules related to TDS and TCS in the case of dead. Under this, if the deductor or collector dies before the PAN and Aadhaar are linked, then higher tax rates will not be applicable on it, so that there will be no additional burden of tax.

CBDT had issued this information in a circular on August 5, 2024. The department has taken this step after receiving many complaints from taxpayers.

Taxpayers had said in the complaint that the department had given time till May 31, 2024 to link PAN-Aadhaar. If the taxpayer dies before this, then his TDS is deducted at higher rates, the department should give exemption in this. Keeping in mind this appeal of the taxpayers, CBDT has announced a change in the rules. Let us tell you that if the PAN of the deductor i.e. the person whose tax has been deducted is not linked to Aadhaar, then tax is deducted at a higher rate. Whereas this can be avoided by PAN-Aadhaar linking.

Also Read : Old pension scheme: Govt said this regarding extending the deadline of the old pension scheme

The date for linking PAN-Aadhaar was extended

Earlier, CBDT had issued a circular informing about the extension of the deadline for linking PAN-Aadhaar. In which the date for linking PAN and Aadhaar for transactions made till March 31, 2024 was extended to 31.05.2024. By doing this, taxpayers can avoid high TDS / TCS. The department has uploaded the complete details about this on the official website www.incometaxindia.gov.in, which you can download and see.

I am 85 yrs, will you give me a job-I am PhD (IISc) holder.