New Delhi. The last date for filing ITR is coming closer and companies have also started asking for investment declaration from their employees. Saving tax is a tough job for those doing private jobs.

The government had also implemented a new regime to save tax. But, the problem in the new regime is that there is no tax exemption on any investment. As soon as your salary goes above 7.5 lakhs, tax starts getting deducted. We are telling you such a method, where your salary up to 10 lakhs will be completely tax free even in the new regime.

Let us tell you that in the new regime, tax exemption is still available for some things. If you have taken any allowance for travel, transport and office work, then tax exemption can be claimed on that too. We will tell you about one such allowance, by adopting which tax can be saved. Private companies give such allowances to their employees and tax can be easily claimed on it.

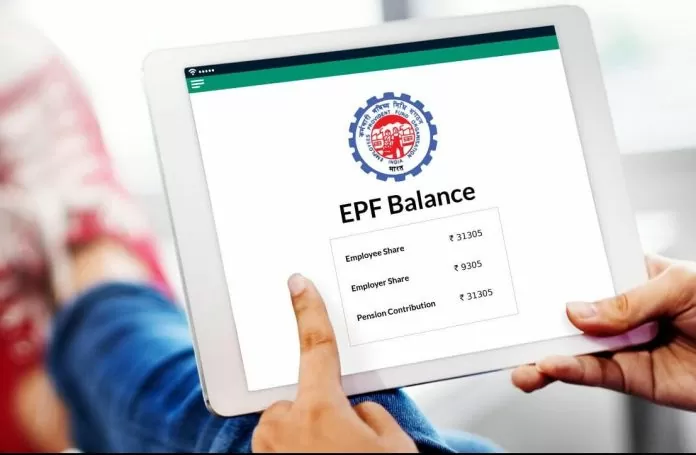

Also Read : EPF New Rules: EPFO issued SOP for freezing and de-freezing UAN, know the details

How to get tax exemption:

In the income tax law, the allowance received for office expenses is kept out of the scope of tax. This includes fuel and mobile, broadband allowances. After the work from home ends, companies may not give broadband allowance, but they give fuel allowance for commuting to and from the office. If you have a car or bike, then this type of allowance can be claimed.

What you have to do:

In most private and MNC companies, a part of the salary of the employees is also for fuel reimbursement. You can talk to your HR about this. If your company also has such a policy, then your HR will revise the salary and can put a big part of it in fuel allowance. You will get tax exemption on this entire amount and if any TDS is being deducted by the company, then that deduction will stop.

How much discount can be given

Every company has its own rules and limits. But, on an average, employees who travel by car get up to Rs 20,000 as fuel expenses. This amount becomes Rs 2.40 lakh in a year. Now if your cash in hand salary is around Rs 10 lakh, then after deducting this amount from it, your salary comes down to Rs 7.5 lakh. As soon as this happens, you become out of the scope of income tax under the new tax regime.