Income tax return filing for FY23-24 : The ITR filing deadline for salaried taxpayers is linked to the timeline for issuing Form 16 by their employers. This important document containing information about income and tax deduction is usually issued by mid-June.

Income tax return filing

Taxpayers can use the e-filing portal of the Income Tax Department to file ITR. Despite this option, experts suggest taxpayers to wait for some time as Form 26AS and AIS have been updated, which will make the process of filing ITR easier.

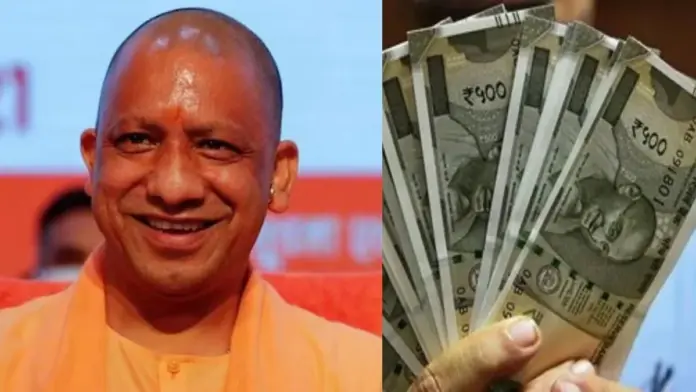

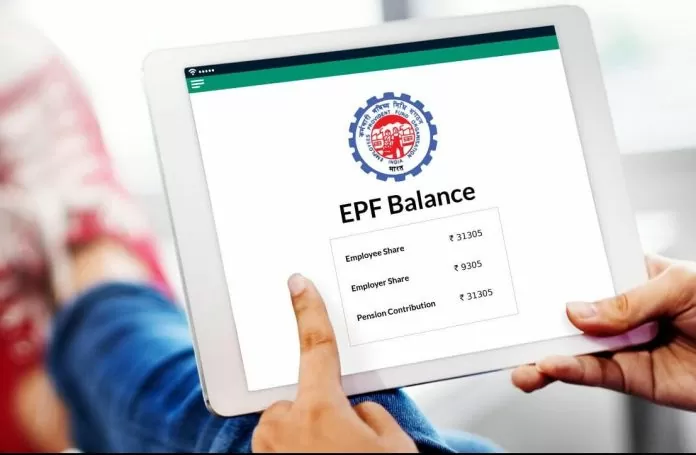

Also Read: EPFO Rule Changed: You will get Rs 1,00,000 from EPF in three day, read in details

It is necessary to link Aadhaar with PAN.

ITR can be filed online through the e-filing portal of the Income Tax Department. It is mandatory for all taxpayers to link their Aadhar card and PAN to file ITR.

Form for filing income tax return

There are several ITR forms that taxpayers should choose from category wise. The Income Tax Department has issued seven types of forms for taxpayers to select. These forms are ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6 and ITR-7.

These documents will be required

It is necessary to collect documents to file ITR. From salary slip to bank account information, taxpayers will have to ensure that they have information about income, expenses and investments. ITR forms are attachment-free forms and hence, taxpayers are not required to attach any documents (like proof of investment, TDS certificate, etc.) along with the return of income (even if filed manually).

They can file electronically. However, taxpayers should retain documents like Form 16, Form 26AS, salary slip, PAN, Aadhar, rent and investment slip with them. So that it can be used at the time of need. Once the necessary paperwork is done, taxpayers can start filing through the e-filing portal of the Income Tax Department.