There is a possibility of Income Tax Return (ITR) getting rejected if it is not filed properly. That is why tax experts advise to be careful while filling the ITR form. They also say that taxpayers should not file returns in a hurry.

If for any reason taxpayers are facing difficulty in filing returns, then they should use the consultancy services of a CA or tax expert. The reason for this is that taxpayers have to face problems after their income tax returns are rejected. Let us know what mistakes taxpayers should generally avoid.

1. Wrong information in the form

Taxpayers should not give any wrong information in the income tax form. They should not claim any deduction which they are not entitled to. Before submitting the form, every information should be checked once or twice. Many times, due to calculation mistakes, wrong information is entered in the form, due to which the form gets rejected. It is also important for taxpayers to pay attention to using the correct form to file the return.

Also Read : Aadhaar Card Rules: Aadhaar Card Enrollment ID can no longer be used for these purposes

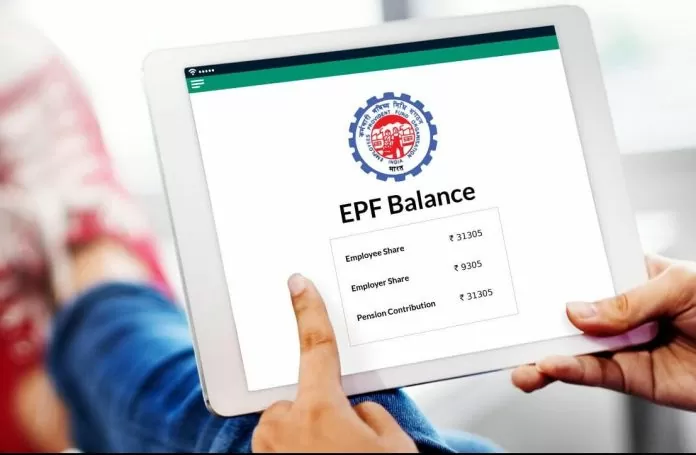

2. Difference in data of Form 16 and AIS

The Income Tax Department has many ways to keep an eye on every financial of the taxpayers. Annual Information Statement (AIS) is the most important among them. Similarly, the most important document for salaried taxpayers is Form-16. Before filing income tax return, it is important to understand the information given in Form 16 and AIS properly. This will reduce the chances of wrong information going into ITR. Taxpayers are advised to match the data of Form 16 and AIS.

3. Not submitting the form by the deadline

It is necessary to submit the ITR form before the last date of filing ITR. Usually, taxpayers fill the ITR form in advance but they do not submit it. If the form is not submitted on time due to some reason, their return may get rejected. After the form is rejected, the return will have to be filed again with a penalty.

4. Mistake in tax calculation

There is a possibility of ITR being rejected even if there is a mistake in the calculation of tax liability. Therefore, before filing the return, taxpayers should calculate their tax liability correctly. They should calculate the deduction, exemption and tax rate correctly. If any kind of problem is faced, then advice of a tax expert can be taken.

5. Not verifying the form

After submitting the income tax return, it is necessary to verify it. There are many ways to verify it. It can be verified through OTP from Aadhaar. It can be verified using netbanking. ITR-V form can be signed and sent to the Central Processing Center in Bangalore. If you file ITR and forget to verify it, then your return will be considered invalid. There is a deadline to verify ITR.