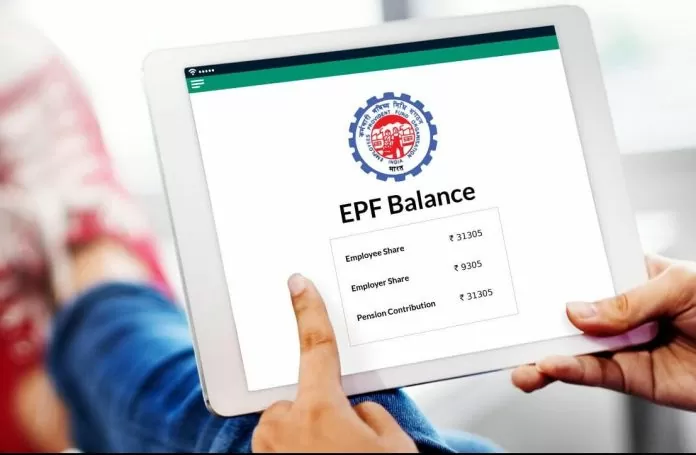

Public Provident Fund (PPF) is a government savings scheme aimed at promoting long-term investment. Investing in PPF is a reliable way to tackle inflation in the long term. By investing regularly in it, you can accumulate more than Rs 1 crore. Here we are telling you how this financial goal can be achieved

Investing in Public Provident Fund (PPF) is a reliable way to tackle inflation in the long term. By investing regularly in it, you can accumulate more than Rs 1 crore. Here we are telling you how to achieve this financial goal.

Know about PPF

PPF is a government saving scheme, which aims to promote long term investment. The government reviews the interest rate of this scheme on a quarterly basis and for the current quarter, this rate is 7.1 percent. Tax exemption is also available on this scheme. Its investment, interest, maturity amount etc. are all tax free.

benefit of compound interest

The importance of returns in PPF is also related to compound interest. With regular investment and the facility of compound interest on it, your investment grows rapidly. According to an estimate, if you invest Rs 1.5 lakh annually for 15 years, then you will get a total interest of Rs 18.18 lakh and you can get a total amount of Rs 40.68 lakh. Also, if you invest Rs 1.5 lakh annually for 20 years, you will get an interest of Rs 36.58 lakh, while the maturity value can be Rs 66.58 lakh. If you invest Rs 1.5 lakh for 30 years, then you can get a total amount of up to Rs 1.54 crore.

This estimate is based on ClearTax estimates. You will find many more calculators online that can help you estimate your returns.

Benefits of PPF

Tax Benefits: If you invest in PPF, you can get a deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act, 1961.

Tax-free returns: The interest and maturity amount on this investment is completely tax free.

Safe investment: PPF is a government scheme, hence it is a safe investment option.

Conclusion

It takes patience and discipline to become a crorepati through PPF. If you invest the maximum amount for a long period and make proper use of account extensions, you can take advantage of the facility of this scheme and achieve your financial goals.